Guard Personal Information:

Never share personal details like Social Security numbers, bank account details, or passwords with unknown sources.

Secure Online Accounts:

Use strong, unique passwords for different accounts and enable two-factor authentication.

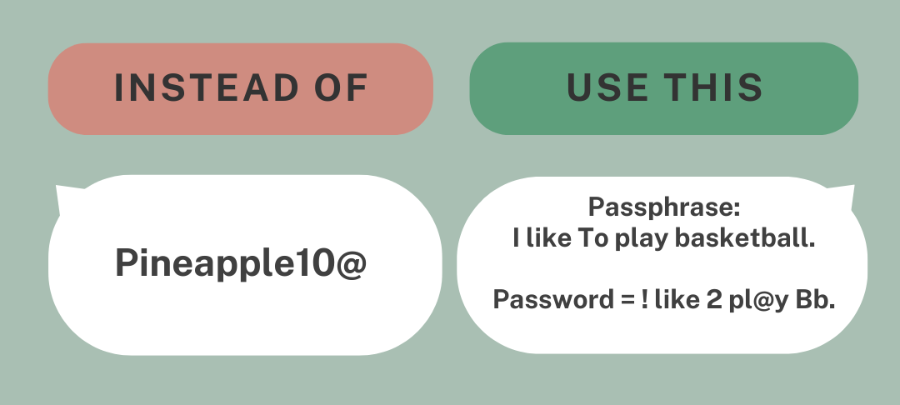

Secure Password Tips:

1. Use a long passphrase

-

-

- For example, you can use a passphrase such as a news headline or even the title of the last book you read. Then add in some punctuation, number and capitalization.

-

.png)

Monitor Financial Statements:

Regularly check bank and credit card statements for any unauthorized transactions.

Verify Requests:

Confirm the legitimacy of requests for money or information, especially if they seem urgent or unusual.

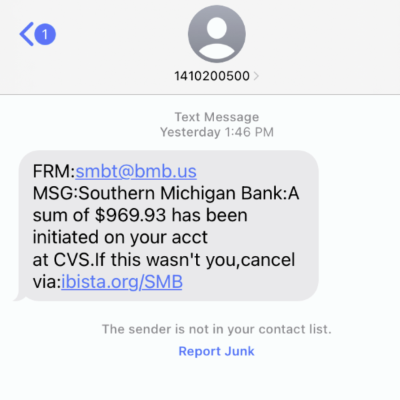

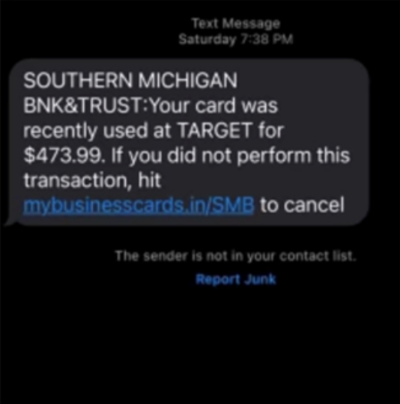

Beware of Phishing:

Be cautious of emails, texts, or phone calls requesting personal information or urging immediate action.

If you think you are a victim of fraud, please report it immediately. For more information, visit ID Theft and Fraud Reporting.